As an answer to the most recent recession in the housing market in Canada, REMAX Canada released a report analyzing the local Canadian housing markets over the last 30 years. Over this period of time the report concludes that investment in bricks and mortar has always been one of the principal and securest option.

The market for residential housing throughout Canada still shocked economists and housing analysts according to the report. There have been three great slumps in the Canadian housing market over the last 30 years, two of them were in the 1980's and the most recent in 2008. In comparison to the 1981 and 1989 market downturns the downturn in 2008 was the quickest with sales and prices quickly flourishing again. Buyers have lost their market, which has now pivoted into leveraged or even a sellers' market.

Long term soundness of real estate investments is based on various factors in Canadians established belief in houses and condos. Real estate exhibits fiscal and material "fortresses" for most Canadian investors. Over the last three decades there has been a significant rise in the purchase of houses of over 6%. With a 12% rise, Calgary has seen an even larger increase in property purchase.

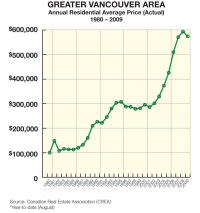

Regardless of the above communicated downturns and smaller variations, real estate remained a very well appreciating investment, with Vancouver, Victoria and Toronto as rulers in terms of price appreciation. This years greatest increase in the real estate market comes from the Greater Vancouver area with a massive 14% increase. The major buyers are depicted by first-entry purchasers, however the over $1 million segment is also being galvanized by trade-up buyers.

Vancouver is classified the greatest performing market in the whole of Canada for housing price increases.

In Vancouver real estate prices have grown nearly 500% in comparison to just over 350% for the rest of Canada since 1980. There has been a 10% increase in house ownership since 1981. Just compare this with inflation for the corresponding period. Over the same period there was a 156.6% increase in inflation looking at the Bank of Canada calculator. In other words: investing $100,000 into real estate 30 years ago would bring you almost $320,000 net return.

This information is not news to nearly all Canadians. Real estate rather than stock investment is the favorite choice of 77% of Canadians according to the September survey administered by The Angus Reid Omnibus.